Difference between revisions of "Cost of structural steelwork"

Zoe Williams (talk | contribs) |

|||

| (41 intermediate revisions by 3 users not shown) | |||

| Line 5: | Line 5: | ||

The information presented here is based on a [[Steel_construction_news#Building_magazine_.E2.80.93_Steel_Insight|series of articles]] written by Gardiner & Theobald LLP, and published in [http://www.building.co.uk Building Magazine] from October 2011 to October 2016. This has been developed further with information from a [[Steel_construction_news#Building_magazine_.E2.80.93_Costing_Steelwork|series of articles]] written by AECOM, also published in [http://www.building.co.uk Building Magazine], from 2017 onwards. | The information presented here is based on a [[Steel_construction_news#Building_magazine_.E2.80.93_Steel_Insight|series of articles]] written by Gardiner & Theobald LLP, and published in [http://www.building.co.uk Building Magazine] from October 2011 to October 2016. This has been developed further with information from a [[Steel_construction_news#Building_magazine_.E2.80.93_Costing_Steelwork|series of articles]] written by AECOM, also published in [http://www.building.co.uk Building Magazine], from 2017 onwards. | ||

| − | {{#image_template:image=File: | + | {{#image_template:image=File:Costing_Steelwork_34.jpg|align=right|wrap=true|width=500}} |

==Introduction== | ==Introduction== | ||

| Line 68: | Line 68: | ||

Accurate forecasts of steel frame costs are challenging due to the uncertainty of general economic conditions and the fluctuation of material prices experienced in the UK steel industry through the economic cycle. | Accurate forecasts of steel frame costs are challenging due to the uncertainty of general economic conditions and the fluctuation of material prices experienced in the UK steel industry through the economic cycle. | ||

| − | + | The Office for National Statistics’ latest data release reported that all work construction output decreased by 0.5% in the year to August 2023. New work output declined by 1.5% over the same period. The construction industry overall has offered durable activity levels after the pandemic until now, despite emerging weakness elsewhere in the economy. However, sub-sector output data reveals changes that the overall output narrative might not immediately convey. In a stark change to the narrative for many recent years, private housing output volume dropped by 15% in the year to August 2023. Housing output is expected to continue posting slower activity levels over the remainder of 2023 and into 2024, although it is declining from a very high nominal level of output. Some of the latest falls in housing output were offset by increases in the infrastructure and repair and maintenance sub-sectors, but these need to be sustained in order to ensure the industry does not generate adverse headlines about notable falls in total output. | |

| − | The | + | Construction output trends are evolving to sketch a different picture expected for the next period of this market cycle. The bounce-back in activity after the initial stages of the pandemic saw a one-way market across much of the industry. Although total industry output adjusted for inflation did not quite reach pre-pandemic levels, it was a sustained period of improving total workload and activity. External forces, building for some time, are now clearly acting on the industry to crimp demand for construction services and its outputs. Inflation was the first major issue that impacted demand, although it did not lead to a consequential adverse dent in the overall activity trend. Project and design reviews have increased, along with the use of so-called value engineering, often to buy some time. Yet it is now higher interest rates and costs of borrowing that are materially hitting demand and activity. |

| − | + | As overall construction output remains in relatively decent shape, industry sentiment indicators confirm the neutral to broadly positive views across the industry. This is an aggregate view, and momentum is adjusting across the industry’s sub-sectors. Respective sentiment measures are already diverging to some extent and will become more nuanced in response to these evident changes in sub-sector activity. Still, at an aggregate level, the industry offers respectable workload and opportunities from the existing momentum and some resilience to the headwinds elsewhere in the economy. Nevertheless, the effects of the rising interest rate environment are impacting construction activity now, and sentiment surveys will eventually reflect this changing picture. | |

| − | |||

| − | |||

'''Tender price trends'''<br> | '''Tender price trends'''<br> | ||

| − | The | + | The intense input cost pressures experienced over the last two years in many construction materials categories have largely receded. This is not to say input costs are falling across the board, only that the continuously upward cost pressures are abating or have ceased across a larger number of categories. AECOM’s building cost index – a composite measure of materials and labour costs – increased at an annual rate of just over 1% up to August 2023. However, the composite nature of the index and its aggregate measure of change mask two differing trends within the composite index. There is a clear divergence in the respective trends for materials inflation and labour rate inflation. An average measure for materials inflation shows negligible change over the year across a basket of items. Wage rates, on average, are still rising strongly at over 5% when compared to the middle point of 2022. |

| − | |||

| − | |||

| − | + | Tender prices rose more slowly over the 12 months to the end of Q2 2023. AECOM’s tender price inflation index recorded a 9.1% change across this period, continuing the elevated rate of inflation seen over the last 18 months. In other words, tender prices are still rising when measured against the same time a year ago, however a slower pace of inflation is now being tracked. Although prices were still rising at a notable pace at mid-2023 compared to a year ago, this juncture very likely registers a high-water mark in this part of the tender price inflation cycle. Price inflation will continue over the remainder of 2023 and into early 2024, though at a slower rate to that recorded at times over the previous 18 months. | |

| − | + | AECOM’s baseline forecast for tender prices is a 3% increase from Q4 2023 to Q4 2024, and a 3% increase from Q4 2024 to Q4 2025. As construction industry output moderates and is expected to continue slowing over the next 12 months, there will be on-going trend divergence across its sub-sectors. The balance of risks to forecasts of price trends is balanced evenly over the first 12-month forecast period due to competing upside and downside factors, and with a downside skew in the following period. Tender price trends retain momentum from labour rates that are still rising at well over 5% on average. Some trades are higher still, partly because of overall capacity in the industry that is historically stretched. The twist for the end of 2023 and into 2024 will be how tempted the supply chain might be to consider projects with a lower potential project margin, if aggregate industry output is set to falter. | |

{|class="wikitable" width=800 style="text-align: center" | {|class="wikitable" width=800 style="text-align: center" | ||

| Line 90: | Line 86: | ||

!'''Quarter'''!!'''2019'''!!'''2020'''!!'''2021'''!!'''2022'''!!'''2023'''!!'''2024'''!!'''2025''' | !'''Quarter'''!!'''2019'''!!'''2020'''!!'''2021'''!!'''2022'''!!'''2023'''!!'''2024'''!!'''2025''' | ||

|- | |- | ||

| − | |1||117.9||120.4||120.0||131.2||145.3|| | + | |1||117.9||120.4||120.0||131.2||145.3||149.6||154.2 |

|- | |- | ||

| − | |2||118.3||121.0||122.6||134.5|| | + | |2||118.3||121.0||122.6||134.5||146.6||150.7||155.4 |

|- | |- | ||

| − | |3||119.3||119.1||125.3||138.1|| | + | |3||119.3||119.1||125.3||138.1||147.5||151.9||156.6 |

|- | |- | ||

| − | |4||119.8||119.1||127.5||142.3|| | + | |4||119.8||119.1||127.5||142.3||148.5||153.0||157.5 |

|} | |} | ||

''Aecom Tender Price Index: 2015 = 100'' | ''Aecom Tender Price Index: 2015 = 100'' | ||

| Line 162: | Line 158: | ||

{|class="wikitable" width=750 style="text-align: center" | {|class="wikitable" width=750 style="text-align: center" | ||

| − | |+'''Table of indicative cost ranges ( | + | {|class="wikitable" width=750 style="text-align: center" |

| + | |+'''Table of indicative cost ranges (Q4, 2025) based on Gross Internal Floor Area (GIFA)''' | ||

|- | |- | ||

!colspan="2"|'''Type'''!!'''GIFA Rate (£/m<sup>2</sup>)<br>BCIS Index 100''' | !colspan="2"|'''Type'''!!'''GIFA Rate (£/m<sup>2</sup>)<br>BCIS Index 100''' | ||

|- | |- | ||

| − | |style="text-align: left" rowspan="3"|Frame||style="text-align: left"|Low rise, short spans, repetitive grid / sections, easy access (55kg/m<sup>2</sup> steelwork)|| | + | |style="text-align: left" rowspan="3"|Frame||style="text-align: left"|Low rise, short spans, repetitive grid / sections, easy access (55kg/m<sup>2</sup> steelwork)||159 - 191 |

|- | |- | ||

| − | |style="text-align: left"|High rise, long spans, easy access, repetitive grid (90kg/m<sup>2</sup> steelwork)|| | + | |style="text-align: left"|High rise, long spans, easy access, repetitive grid (90kg/m<sup>2</sup> steelwork)||266 - 301 |

|- | |- | ||

| − | |style="text-align: left"|High rise, long spans, complex access, irregular grid, complex elements (110kg/m<sup>2</sup> steelwork)|| | + | |style="text-align: left"|High rise, long spans, complex access, irregular grid, complex elements (110kg/m<sup>2</sup> steelwork)||304 - 364 |

|- | |- | ||

| − | |style="text-align: left" rowspan="2"|Floor||style="text-align: left"|Composite floors, metal decking and lightweight concrete topping|| | + | |style="text-align: left" rowspan="2"|Floor||style="text-align: left"|Composite floors, metal decking and lightweight concrete topping||111 - 151 |

|- | |- | ||

| − | |style="text-align: left"|Hollowcore precast concrete composite floor with concrete topping|| | + | |style="text-align: left"|Hollowcore precast concrete composite floor with concrete topping||138 - 194 |

|- | |- | ||

| − | |style="text-align: left" rowspan="2"|Fire protection||style="text-align: left"|Factory applied intumescent (60 minutes resistance)|| | + | |style="text-align: left" rowspan="2"|Fire protection||style="text-align: left"|Factory applied intumescent (60 minutes resistance)||29 - 40 |

|- | |- | ||

| − | |style="text-align: left"|Factory applied intumescent (90 minutes resistance)|| | + | |style="text-align: left"|Factory applied intumescent (90 minutes resistance)||38 -58 |

|- | |- | ||

| − | |style="text-align: left" rowspan="2"|Portal frames||style="text-align: left"|Large span single storey building with low eaves (6 - 8 m), 35kg/m<sup>2</sup> steelwork|| | + | |style="text-align: left" rowspan="2"|Portal frames||style="text-align: left"|Large span single storey building with low eaves (6 - 8 m), 35kg/m<sup>2</sup> steelwork||114 - 149 |

|- | |- | ||

| − | |style="text-align: left"|Large span single storey building with high eaves (10 - 13 m), 45kg/m<sup>2</sup> steelwork|| | + | |style="text-align: left"|Large span single storey building with high eaves (10 - 13 m), 45kg/m<sup>2</sup> steelwork||139 - 178 |

|} | |} | ||

<br> | <br> | ||

| Line 191: | Line 188: | ||

<br> | <br> | ||

For example, for a low rise, short span building with a composite [[Composite_construction#Composite_slabs|metal deck floor]] and 60 minutes [[Structural_fire_resistance_requirements|fire resistance]], the overall frame rate (based on the average of each range) would be:<br> | For example, for a low rise, short span building with a composite [[Composite_construction#Composite_slabs|metal deck floor]] and 60 minutes [[Structural_fire_resistance_requirements|fire resistance]], the overall frame rate (based on the average of each range) would be:<br> | ||

| − | ''' | + | '''£174.50 + £114.00 + £34.50 = £324.00 per m² GIFA''' |

The rates should then be adjusted using location indices; the table provided below contains a selection of indices as published and updated by the [http://www.rics.org/uk/knowledge/bcis/about-bcis/construction/ BCIS]. | The rates should then be adjusted using location indices; the table provided below contains a selection of indices as published and updated by the [http://www.rics.org/uk/knowledge/bcis/about-bcis/construction/ BCIS]. | ||

| + | |||

{|class="wikitable" width=600 style="text-align: center" | {|class="wikitable" width=600 style="text-align: center" | ||

| − | |+'''Table of BCIS location factors (at | + | |+'''Table of BCIS location factors (at Q4, 2025)''' |

|- | |- | ||

!'''Location'''!!'''BCIS Index'''!!'''Location'''!!'''BCIS Index''' | !'''Location'''!!'''BCIS Index'''!!'''Location'''!!'''BCIS Index''' | ||

|- | |- | ||

| − | |style="text-align: left"|Central London|| | + | |style="text-align: left"|Central London||122||style="text-align: left"|Nottingham||102 |

|- | |- | ||

| − | |style="text-align: left"|Manchester||102||style="text-align: left"|Glasgow|| | + | |style="text-align: left"|Manchester||102||style="text-align: left"|Glasgow||92 |

|- | |- | ||

| − | |style="text-align: left"|Birmingham|| | + | |style="text-align: left"|Birmingham||98||style="text-align: left"|Newcastle||89 |

|- | |- | ||

| − | |style="text-align: left"|Liverpool|| | + | |style="text-align: left"|Liverpool||100||style="text-align: left"|Cardiff||102 |

|- | |- | ||

| − | |style="text-align: left"|Leeds|| | + | |style="text-align: left"|Leeds||90||style="text-align: left"|Dublin<sup>+</sup>||90 |

|} | |} | ||

| + | |||

| + | |||

''<sup>+</sup>Aecom index'' | ''<sup>+</sup>Aecom index'' | ||

| Line 268: | Line 268: | ||

The series comprises studies into [[Multi-storey_office_buildings|office]], [[Education_buildings|education]], [[Residential_and_mixed-use_buildings|residential/mixed-use]], [[Retail_buildings|retail]] and [[Single_storey_industrial_buildings|industrial buildings]], and a key feature is a series of building type specific cost comparisons based on actual buildings. The buildings selected were originally part of the [[Target_Zero|Target Zero]] study conducted by a consortium of organisations including Tata Steel, [http://www.aecom.com/uk/ AECOM], SCI, Cyril Sweet and BCSA in 2010 to provide guidance on the [[Design|design]] and [[Construction|construction]] of sustainable, low and zero carbon buildings in the UK. | The series comprises studies into [[Multi-storey_office_buildings|office]], [[Education_buildings|education]], [[Residential_and_mixed-use_buildings|residential/mixed-use]], [[Retail_buildings|retail]] and [[Single_storey_industrial_buildings|industrial buildings]], and a key feature is a series of building type specific cost comparisons based on actual buildings. The buildings selected were originally part of the [[Target_Zero|Target Zero]] study conducted by a consortium of organisations including Tata Steel, [http://www.aecom.com/uk/ AECOM], SCI, Cyril Sweet and BCSA in 2010 to provide guidance on the [[Design|design]] and [[Construction|construction]] of sustainable, low and zero carbon buildings in the UK. | ||

| − | The cost comparisons presented in the ‘[[Steel_construction_news#Building_magazine_.E2.80.93_Costing_Steelwork|Costing Steelwork]]’ series update the cost models developed for the [[Target_Zero|Target Zero]] project | + | The cost comparisons presented in the ‘[[Steel_construction_news#Building_magazine_.E2.80.93_Costing_Steelwork|Costing Steelwork]]’ series update the cost models developed for the [[Target_Zero|Target Zero]] project. The cost comparison studies have been suspended for the time being as it is felt that the buildings’ designs are no longer reflective of current practices. Steel for Life and AECOM are collaborating on a new model to be released in the future, so please take this into consideration when using the data below, which was last produced in December 2023. |

===Office building=== | ===Office building=== | ||

| Line 282: | Line 282: | ||

Two structural options for the office building were assessed; a steel frame comprising fabricated [[Steel_construction_products#Cellular beams|cellular steel beams]] acting compositely with a lightweight concrete slab on a [[Steel_construction_products#Decking for floors|profiled steel deck]], and a 350mm thick post tensioned concrete flat slab with a 650 x 1050mm perimeter beam. | Two structural options for the office building were assessed; a steel frame comprising fabricated [[Steel_construction_products#Cellular beams|cellular steel beams]] acting compositely with a lightweight concrete slab on a [[Steel_construction_products#Decking for floors|profiled steel deck]], and a 350mm thick post tensioned concrete flat slab with a 650 x 1050mm perimeter beam. | ||

| − | The full building cost plans for each structural option have been reviewed and updated to provide current costs at | + | The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4, 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below. |

{|class="wikitable" width=500 style="text-align: center" | {|class="wikitable" width=500 style="text-align: center" | ||

| − | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for City of London Office Building ( | + | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for City of London Office Building (Q4, 2023)''' |

|- | |- | ||

! style="width: 35%"|Elements!!style="width: 33%"|'''Steel cellular composite'''!!style="width: 33%"|'''Post-tensioned concrete flat slab''' | ! style="width: 35%"|Elements!!style="width: 33%"|'''Steel cellular composite'''!!style="width: 33%"|'''Post-tensioned concrete flat slab''' | ||

| Line 291: | Line 291: | ||

|style="text-align: left"|'''Substructure'''||93||98 | |style="text-align: left"|'''Substructure'''||93||98 | ||

|- | |- | ||

| − | |style="text-align: left"|'''Frame and upper floors'''|| | + | |style="text-align: left"|'''Frame and upper floors'''||556||540 |

|- | |- | ||

| − | |style="text-align: left"|'''Total building'''||'''3, | + | |style="text-align: left"|'''Total building'''||'''3,660'''||'''3,750''' |

|} | |} | ||

<br> | <br> | ||

| − | The analysis shows that the cost of the [[Composite_construction|steel composite]] solution is | + | The analysis shows that the cost of the [[Composite_construction|steel composite]] solution is 3% higher than the post-tensioned concrete flat slab alternative in terms of the frame and upper floors, but 2% lower on a total building basis. The lighter frame weight and the increased speed of erection results in reduced foundations and a quicker programme. The reduced timescale is the main reason for the overall building cost to be less in the steel composite option. |

===Secondary school building=== | ===Secondary school building=== | ||

| Line 311: | Line 311: | ||

Three structural options for the building were assessed; a steel frame with 250mm hollowcore [[Floor_systems#Precast units|precast concrete planks]] and a 75mm structural screed, an in situ 350mm reinforced concrete flat slab with 400 x 400mm columns, and a steel frame acting compositely with a 130mm concrete topping on [[Steel_construction_products#Decking for floors|structural metal deck]]. | Three structural options for the building were assessed; a steel frame with 250mm hollowcore [[Floor_systems#Precast units|precast concrete planks]] and a 75mm structural screed, an in situ 350mm reinforced concrete flat slab with 400 x 400mm columns, and a steel frame acting compositely with a 130mm concrete topping on [[Steel_construction_products#Decking for floors|structural metal deck]]. | ||

| − | The full building cost plans for each structural option have been reviewed and updated to provide current costs at | + | The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below. |

{|class="wikitable" width=700 style="text-align: center" | {|class="wikitable" width=700 style="text-align: center" | ||

| − | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Merseyside secondary school ( | + | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Merseyside secondary school (Q4, 2023)''' |

|- | |- | ||

! style="width: 25%"|Elements!!style="width: 25%"|'''Steel and precast hollowcore planks'''!!style="width: 25%"|'''In situ concrete flat slab'''!!style="width: 25%"|'''Steel composite''' | ! style="width: 25%"|Elements!!style="width: 25%"|'''Steel and precast hollowcore planks'''!!style="width: 25%"|'''In situ concrete flat slab'''!!style="width: 25%"|'''Steel composite''' | ||

|- | |- | ||

| − | |style="text-align: left"|'''Frame and upper floors'''|| | + | |style="text-align: left"|'''Frame and upper floors'''||379||321||340 |

|- | |- | ||

| − | |style="text-align: left"|'''Total building'''||'''4, | + | |style="text-align: left"|'''Total building'''||'''4,090'''||'''4,048'''||'''4,010''' |

|} | |} | ||

| − | The comparative costs highlight the importance of considering total building cost when selecting the structural frame material during [[Design|design]]. The concrete flat slab option has a marginally lower frame and floor cost compared with the [[Composite_construction|steel composite]] option, but on a total building basis, the steel composite option has a lower overall cost ( | + | The comparative costs highlight the importance of considering total building cost when selecting the structural frame material during [[Design|design]]. The concrete flat slab option has a marginally lower frame and floor cost compared with the [[Composite_construction|steel composite]] option, but on a total building basis, the steel composite option has a lower overall cost (£4,010/m<sup>2</sup> compared with £4,048/m<sup>2</sup>). This is because of lower substructure and roof costs and lower preliminaries resulting from the shorter programme. |

===Distribution warehouse=== | ===Distribution warehouse=== | ||

| Line 335: | Line 335: | ||

Three structural options for the building were assessed; a steel [[Portal_frames|portal frame]] with a simple roof solution, a hybrid option, consisting of precast concrete columns and glulam beams with timber rafters, and a steel [[Portal_frames|portal frame]] with a northlight roof solution. | Three structural options for the building were assessed; a steel [[Portal_frames|portal frame]] with a simple roof solution, a hybrid option, consisting of precast concrete columns and glulam beams with timber rafters, and a steel [[Portal_frames|portal frame]] with a northlight roof solution. | ||

| − | The full building cost plans for each structural option have been reviewed and updated to provide current costs at | + | The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below. |

{|class="wikitable" width=600 style="text-align: center" | {|class="wikitable" width=600 style="text-align: center" | ||

| − | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Stoke-on-Trent distribution warehouse ( | + | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Stoke-on-Trent distribution warehouse (Q4, 2023)''' |

|- | |- | ||

! style="width: 25%"|Elements!!style="width: 25%"|'''Steel portal frame'''!!style="width: 25%"|'''Glulam beams and purlins supported on concrete columns'''!!style="width: 25%"|'''Steel portal frame with northlights''' | ! style="width: 25%"|Elements!!style="width: 25%"|'''Steel portal frame'''!!style="width: 25%"|'''Glulam beams and purlins supported on concrete columns'''!!style="width: 25%"|'''Steel portal frame with northlights''' | ||

|- | |- | ||

| − | |style="text-align: left"|'''Warehouse'''|| | + | |style="text-align: left"|'''Warehouse'''||123||187||142 |

|- | |- | ||

| − | |style="text-align: left"|'''Office'''||187|| | + | |style="text-align: left"|'''Office'''||187||227||187 |

|- | |- | ||

| − | |style="text-align: left"|'''Total frame'''|| | + | |style="text-align: left"|'''Total frame'''||127||189||145 |

|- | |- | ||

| − | |style="text-align: left"|'''Total building'''||''' | + | |style="text-align: left"|'''Total building'''||'''920'''||'''995'''||'''963''' |

|} | |} | ||

| − | The steel [[Portal_frames|portal frame]] option provides the optimum build value at | + | The steel [[Portal_frames|portal frame]] option provides the optimum build value at £920/m<sup>2</sup>, with the hybrid concrete/glulam option being the least cost-efficient. This is primarily due to the cost premium for the structural members required to provide the required spans, which are otherwise efficiently catered for in the steelwork solution. The consequence of having a hybrid option is that the component elements are from different suppliers, which contributes to the increases in cost. |

The northlights option is directly comparable with the [[Portal_frames|portal frame]] in relation to the [[Retail_buildings#Distribution warehouses|warehouse]] and office frame; the variance is in the roof framing. There is significantly more roof framing to form the northlights. The additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area. | The northlights option is directly comparable with the [[Portal_frames|portal frame]] in relation to the [[Retail_buildings#Distribution warehouses|warehouse]] and office frame; the variance is in the roof framing. There is significantly more roof framing to form the northlights. The additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area. | ||

| Line 365: | Line 365: | ||

Three structural options for the building were assessed; a steel [[Portal_frames|portal frame]] on CFA piles, glulam timber rafters and columns on CFA piles, and a steel [[Portal_frames|portal frame]] with a northlight roof solution on driven steel piles. | Three structural options for the building were assessed; a steel [[Portal_frames|portal frame]] on CFA piles, glulam timber rafters and columns on CFA piles, and a steel [[Portal_frames|portal frame]] with a northlight roof solution on driven steel piles. | ||

| − | The full building cost plans for each structural option have been reviewed and updated to provide current costs at | + | The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below. |

{|class="wikitable" width=600 style="text-align: center" | {|class="wikitable" width=600 style="text-align: center" | ||

| − | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Stockton-on-Tees supermarket ( | + | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Stockton-on-Tees supermarket (Q4, 2023)''' |

|- | |- | ||

! style="width: 25%"|Elements!!style="width: 25%"|'''Steel portal frame'''!!style="width: 25%"|'''Glulam timber rafters and columns'''!!style="width: 25%"|'''Steel portal frame with northlights''' | ! style="width: 25%"|Elements!!style="width: 25%"|'''Steel portal frame'''!!style="width: 25%"|'''Glulam timber rafters and columns'''!!style="width: 25%"|'''Steel portal frame with northlights''' | ||

|- | |- | ||

| − | |style="text-align: left"|'''Structural unit cost'''|| | + | |style="text-align: left"|'''Structural unit cost'''||184||234||207 |

|- | |- | ||

| − | |style="text-align: left"|'''Total building unit cost'''||'''3, | + | |style="text-align: left"|'''Total building unit cost'''||'''3,345'''||'''3,400'''||'''3,358''' |

|} | |} | ||

| − | The steel [[Portal_frames|portal frame]] option provides the optimum build value at £3, | + | The steel [[Portal_frames|portal frame]] option provides the optimum build value at £3,345/m<sup>2</sup>, with the glulam option the least cost-efficient. The increased cost is due to the direct comparison of the steel frame solution against the glulam columns and beams/rafters. A significant proportion of the cost for the building is in the M&E services and fit-out elements, which effectively reduce the impact of the structural changes to the overall building. |

The northlights option is directly comparable with the [[Portal_frames|portal frame]] in relation to the main supermarket frame; the variance is in the roof framing as there is significantly more roof framing to form the northlights. The additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area. | The northlights option is directly comparable with the [[Portal_frames|portal frame]] in relation to the main supermarket frame; the variance is in the roof framing as there is significantly more roof framing to form the northlights. The additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area. | ||

| Line 393: | Line 393: | ||

Three frame options were considered to establish the optimum solution for the building, a steel frame with [[Floor_systems#Shallow floors|Slimdek floors]], a concrete flat slab and a [[Composite_construction|steel composite]] deck on [[Steel_construction_products#Cellular beams|cellular beams]] (offices) and [[Steel_construction_products#Standard open sections|UCs]] used as beams (hotel). | Three frame options were considered to establish the optimum solution for the building, a steel frame with [[Floor_systems#Shallow floors|Slimdek floors]], a concrete flat slab and a [[Composite_construction|steel composite]] deck on [[Steel_construction_products#Cellular beams|cellular beams]] (offices) and [[Steel_construction_products#Standard open sections|UCs]] used as beams (hotel). | ||

| − | The full building cost plans for each structural option have been reviewed and updated to provide current costs at | + | The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below. |

{|class="wikitable" width=600 style="text-align: center" | {|class="wikitable" width=600 style="text-align: center" | ||

| − | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Holiday Inn tower, MediaCityUK, Manchester ( | + | |+'''Table of key costs (£/m<sup>2</sup> GIFA), for Holiday Inn tower, MediaCityUK, Manchester (Q4, 2023)''' |

|- | |- | ||

! style="width: 25%"|Elements!!style="width: 25%"|'''Steel frame with Slimdek floors'''!!style="width: 25%"|'''Concrete flat slab'''!!style="width: 25%"|'''Steel frame with composite deck on [[Steel_construction_products#Cellular beams|cellular beams]] (offices) and UCs used as beams (hotel)''' | ! style="width: 25%"|Elements!!style="width: 25%"|'''Steel frame with Slimdek floors'''!!style="width: 25%"|'''Concrete flat slab'''!!style="width: 25%"|'''Steel frame with composite deck on [[Steel_construction_products#Cellular beams|cellular beams]] (offices) and UCs used as beams (hotel)''' | ||

|- | |- | ||

| − | |style="text-align: left"|'''Structural unit cost'''|| | + | |style="text-align: left"|'''Structural unit cost'''||688||500||470 |

|- | |- | ||

| − | |style="text-align: left"|'''Total building unit cost'''||'''3, | + | |style="text-align: left"|'''Total building unit cost'''||'''3,705'''||'''3,490'''||'''3,430''' |

|} | |} | ||

| − | The steel frame with [[Floor_systems#Composite slabs|composite deck]] provides the optimum build value at £3, | + | The steel frame with [[Floor_systems#Composite slabs|composite deck]] provides the optimum build value at £3,430/m<sup>2</sup>. |

However, it is important to note some project-specific factors influencing the decision to use a [[Floor_systems#Shallow floors|Slimdek solution]] for the actual, and hence the base case, building structure. The Holiday Inn tower building is connected to an adjacent studio block between floors one and seven. The long-span requirements for the studio could only be achieved using steel and therefore it was preferable to use a steel structure for the tower block to facilitate the integration of the two structures. [[The_case_for_steel#Speed of construction|Speed of construction]] was also important for the tower block, and this integration gave programme benefits relative to concrete solutions. | However, it is important to note some project-specific factors influencing the decision to use a [[Floor_systems#Shallow floors|Slimdek solution]] for the actual, and hence the base case, building structure. The Holiday Inn tower building is connected to an adjacent studio block between floors one and seven. The long-span requirements for the studio could only be achieved using steel and therefore it was preferable to use a steel structure for the tower block to facilitate the integration of the two structures. [[The_case_for_steel#Speed of construction|Speed of construction]] was also important for the tower block, and this integration gave programme benefits relative to concrete solutions. | ||

| Line 414: | Line 414: | ||

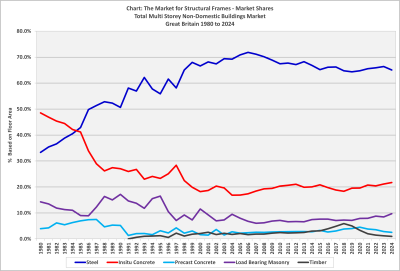

==Market share trend in UK multi-storey construction== | ==Market share trend in UK multi-storey construction== | ||

| − | {{#image_template:image=File: | + | {{#image_template:image=File:Market_share_2024.png|caption= Market shares in the total UK multi-storey buildings market (1980 to 2024) |align=right|wrap=true|width=400}} |

Steel continues to be overwhelmingly the structural framing material of choice for multi-storey non-residential buildings, according to the latest survey from independent market research consultants [http://www.construction-markets.co.uk Construction Markets]. | Steel continues to be overwhelmingly the structural framing material of choice for multi-storey non-residential buildings, according to the latest survey from independent market research consultants [http://www.construction-markets.co.uk Construction Markets]. | ||

| − | The survey, commissioned by BCSA and Steel for Life, is the latest in a series going back to 1980 and is thought to be the biggest of its type in the UK, involving | + | The survey, commissioned by BCSA and Steel for Life, is the latest in a series going back to 1980 and is thought to be the biggest of its type in the UK, involving 753 interviews with construction specifiers. The results show that steel frames continue to have a dominant 65.1% share of the multi-storey non-domestic buildings market. The survey also shows that the market decreased by 4.8% in 2024, with the overall floor area constructed in all multi-storey buildings decreasing to 6,082,000m², which is 59% of the size of the market at its peak of 2008, when it was 15,266,000m². |

Headline figures for the market share in the total multi-storey non-domestic buildings market: | Headline figures for the market share in the total multi-storey non-domestic buildings market: | ||

| − | *65. | + | *65.1% - Steel |

| − | * | + | *21.7% - Concrete |

| − | * | + | *9.7% - Load bearing masonry |

| − | * | + | *2.5% - Precast concrete |

| − | *1. | + | *1.0% - Timber |

<br> | <br> | ||

| − | The survey also shows that steel now has a | + | The survey also shows that steel now has a 74.3% share of the [[Multi-storey_office_buildings|multi-storey offices]] market, and a 60.3% share in the ‘other multi-storey buildings’ sector, which includes [[Retail_buildings|retail]], [[Education_buildings|education]], [[Leisure_buildings|leisure]] and [[Healthcare_buildings|health]]. |

This high market share is due in part to the key cost advantages of steel framing: | This high market share is due in part to the key cost advantages of steel framing: | ||

| Line 475: | Line 475: | ||

*[[Media:Costing_Steelwork-23.pdf|Costing Steelwork 23 – Cost update, March 2023]] | *[[Media:Costing_Steelwork-23.pdf|Costing Steelwork 23 – Cost update, March 2023]] | ||

*[[Media:Costing_Steelwork-24.pdf|Costing Steelwork 24 – Cost update, June 2023]] | *[[Media:Costing_Steelwork-24.pdf|Costing Steelwork 24 – Cost update, June 2023]] | ||

| + | *[[Media:Costing_Steelwork-25.pdf|Costing Steelwork 25 – Cost update, September 2023]] | ||

| + | *[[Media:Costing_Steelwork-26.pdf|Costing Steelwork 26 – Cost update, December 2023]] | ||

| + | *[[Media:Costing_Steelwork-27.pdf|Costing Steelwork 27 – Cost update, March 2024]] | ||

| + | *[[Media:Costing_Steelwork-28.pdf|Costing Steelwork 28 – Cost update, June 2024]] | ||

| + | *[[Media:Costing_Steelwork-29.pdf|Costing Steelwork 29 – Cost update, September 2024]] | ||

| + | *[[Media:Costing_Steelwork-30.pdf|Costing Steelwork 30 – Cost update, December 2024]] | ||

| + | *[[Media:Costing_Steelwork-31.pdf|Costing Steelwork 31 – Cost update, March 2025]] | ||

| + | *[[Media:Costing_Steelwork-32.pdf|Costing Steelwork 32 – Cost update, June 2025]] | ||

| + | *[[Media:Costing_Steelwork-33.pdf|Costing Steelwork 33 – Cost update, September 2025]] | ||

| + | *[[Media:Costing_Steelwork-34.pdf|Costing Steelwork 34 – Cost update, December 2025]] | ||

| + | |||

<br> | <br> | ||

‘Steel Insight’ series (October 2011 – October 2016): | ‘Steel Insight’ series (October 2011 – October 2016): | ||

Latest revision as of 10:07, 15 December 2025

Cost is a fundamental consideration in the selection of structural frame material and form, which is a key early decision in the design process. This selection should be based on project specific costings, and the challenge to the cost consultant is to recognise and reconcile fluctuations in material prices in relation to returned tender price data all in the context of limited available design information during early estimates.

This article outlines a number of key cost drivers that must be considered in order to make steel frame rates project specific, and provides guidance on current cost ranges for different building types and locations. Through the identification of the key factors relevant to each project and the adjustment of typical rates accordingly, the accuracy of budget structural steel estimating can be significantly improved.

The information presented here is based on a series of articles written by Gardiner & Theobald LLP, and published in Building Magazine from October 2011 to October 2016. This has been developed further with information from a series of articles written by AECOM, also published in Building Magazine, from 2017 onwards.

[top]Introduction

Main articles: Cost planning through design stages, Cost comparison study

For most projects, the decision on the frame material choice and form happens early in the design process, often on the basis of early design principles, limited information and budget costings. Once selected, the frame material is unlikely to change, as to do so can have significant programme implications from the consequential impact on the design of other major elements, such as cladding, service installations etc.

While the decision on frame type for most developments will not be based on cost alone, it is nevertheless a key consideration in the decision making process and it is vital to support informed decision making with realistic cost information at this early stage, before refining during the detailed design stages. This is a challenging task as the cost of structural steel may fluctuate through the economic cycle, and reconciling material price information with returned tender prices is not always straightforward. Steel frame costs are also heavily affected by project specific key cost drivers, such as programme, access, spans and building form, making accurate adjustment of recently tendered rates or cost models difficult.

For those with limited previous experience of steel framed construction, the unique characteristics of the sector may not be immediately apparent. Anecdotal stories point to design decisions being made on the basis of non or poorly adjusted historic steel rates, suggesting that the complexities of the industry and the significance of key cost drivers are not necessarily widely understood.

Steel’s high market share for multi-storey buildings of around 65% and a review of recent industry trends highlights the importance of maintaining current, market tested cost advice for structural steelwork. Through a consideration of a number of key factors and consultation with the market and supply chain, budget structural steel estimating can be quickly and successfully tailored to specific projects.

[top]The importance of realistic steel pricing

As the selection of frame material is a key design decision and impacts on so many related building elements – foundations, finishes, wall to floor ratio and cladding to name but a few – once the decision has been made and design has progressed, it is disruptive and generally abortive to make fundamental changes to the frame type or form. To do so would involve going back over design stages already completed and will involve most of the design disciplines. Where there is a programme to be maintained, this is almost impossible to achieve. Therefore, although the period of time to identify and select the best value frame is not a long one, it should not be rushed.

By its very nature therefore, the decision is commonly based on outline design proposals, with a limited amount of information available to the cost consultant.

Where the initial budget estimates of steel frame costs are not realistic, the wrong frame solution can be selected at a higher cost of not only the frame but potentially also the related building elements. It can also have an effect on buildability, logistics and the construction programme, as the frame construction is a critical path activity.

[top]Making the most of the available information

At the early design stages of any project, cost models, benchmarks and historic cost data are key tools used by cost consultants in the estimating of all building elements. At this stage, elemental costs, including that of the structural frame, will usually be expressed as a rate per m² based on the Gross Internal Floor Area (GIFA).

Typical cost ranges for different frame types can be developed through cost models, and there are some indicative ranges given as part of this article, but how should one pitch the rate for any specific project?

Rather than arbitrarily using the highest rate of a range, it is key to interrogate and understand what those rates buy and how the standard ranges can be adapted to suit project specific factors. To do this most accurately, the cost consultant needs to ask relevant questions of the design team and to speak to the supply chain to use this information effectively. This will build a picture of the current and short term future market, rather than relying on indices to adjust benchmark or historic rates.

[top]Key cost drivers

A number of factors can be considered to have a key impact on the price of structural steel frames. These ‘key cost drivers’ can be reviewed as part of the following groups:

- Function, sector and building height

- Form, site conditions and complexity

- Location, logistics and access

- Programme, risk and procurement route

[top]Function, sector and building height

Different building functions across different sectors have varying typical frame costs due to their different usages of the created floor space. The usage of the building will influence the design loadings considered by the structural engineer and the building function will also result in different requirements for clear spans and floor-to-floor heights. This means that the average weight of the steel frame will vary between building types. For example, a low eaves industrial ‘shed’ building could have a frame weight of 40kg/m² GIFA, while a city centre office with a long spanning grid to avoid a forest of columns could have a weight of 90kg/m² GIFA.

A requirement for fewer columns will lead to longer spanning beams and heavier steel sections, which can increase the overall weight of the frame and therefore the cost range for the building. Clearly, these factors need to be considered when determining the rate for the structural frame for early estimates. Confirmation of the design assumptions and principles with the structural engineer is essential to clarify this.

It is also important to remember that the rate per m² is based on gross internal floor area, which will not account for variances in floor-to-floor heights. If for a specific project these are outside the normal range utilised in cost models, a higher or lower rate should be considered to tailor indicative rates to the project.

[top]Form, site conditions and complexity

The complexity of the structure is closely related to building form and function, as well as specific site conditions. The building form will have an impact on the regularity of the structural grid, and the need to introduce non-standard sections, a wide range of different sections and connections in order to achieve structural stability.

Complex structural solutions, such as transfer structures, and fabricated beams may also need to be introduced to overcome project specific features or restrictions such as retained facades, adjacency of other buildings, ground conditions and so on.

The inclusion of non-standard sections will also increase the overall frame rate as fabrication costs are higher. Complex connection details may also impact on installation costs, tolerances and interfaces.

[top]Location, logistics and access

The location of a project is a key factor in price determination and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS Indices, highlight the existence of different market conditions in different regions, which must not be overlooked.

Not only is the geographic location of the site an important consideration, site specific features also need to be reviewed. While the designed frame solution of two buildings may be very similar, the logistics and access arrangements will vary significantly between a city centre congested site and an easily accessible, isolated business park or industrial estate site, or even between alternative city centre sites.

Working in city centre or occupied areas can mean restrictions to working hours, noise, deliveries and craneage, all of which influence installation costs and can result in an extended on site programme. As the frame construction is generally a critical path activity, any increase to the construction programme will have an associated impact on project cost.

[top]Programme, risk and procurement route

Accurate forecasts of steel frame costs are challenging due to the uncertainty of general economic conditions and the fluctuation of material prices experienced in the UK steel industry through the economic cycle.

The Office for National Statistics’ latest data release reported that all work construction output decreased by 0.5% in the year to August 2023. New work output declined by 1.5% over the same period. The construction industry overall has offered durable activity levels after the pandemic until now, despite emerging weakness elsewhere in the economy. However, sub-sector output data reveals changes that the overall output narrative might not immediately convey. In a stark change to the narrative for many recent years, private housing output volume dropped by 15% in the year to August 2023. Housing output is expected to continue posting slower activity levels over the remainder of 2023 and into 2024, although it is declining from a very high nominal level of output. Some of the latest falls in housing output were offset by increases in the infrastructure and repair and maintenance sub-sectors, but these need to be sustained in order to ensure the industry does not generate adverse headlines about notable falls in total output.

Construction output trends are evolving to sketch a different picture expected for the next period of this market cycle. The bounce-back in activity after the initial stages of the pandemic saw a one-way market across much of the industry. Although total industry output adjusted for inflation did not quite reach pre-pandemic levels, it was a sustained period of improving total workload and activity. External forces, building for some time, are now clearly acting on the industry to crimp demand for construction services and its outputs. Inflation was the first major issue that impacted demand, although it did not lead to a consequential adverse dent in the overall activity trend. Project and design reviews have increased, along with the use of so-called value engineering, often to buy some time. Yet it is now higher interest rates and costs of borrowing that are materially hitting demand and activity.

As overall construction output remains in relatively decent shape, industry sentiment indicators confirm the neutral to broadly positive views across the industry. This is an aggregate view, and momentum is adjusting across the industry’s sub-sectors. Respective sentiment measures are already diverging to some extent and will become more nuanced in response to these evident changes in sub-sector activity. Still, at an aggregate level, the industry offers respectable workload and opportunities from the existing momentum and some resilience to the headwinds elsewhere in the economy. Nevertheless, the effects of the rising interest rate environment are impacting construction activity now, and sentiment surveys will eventually reflect this changing picture.

Tender price trends

The intense input cost pressures experienced over the last two years in many construction materials categories have largely receded. This is not to say input costs are falling across the board, only that the continuously upward cost pressures are abating or have ceased across a larger number of categories. AECOM’s building cost index – a composite measure of materials and labour costs – increased at an annual rate of just over 1% up to August 2023. However, the composite nature of the index and its aggregate measure of change mask two differing trends within the composite index. There is a clear divergence in the respective trends for materials inflation and labour rate inflation. An average measure for materials inflation shows negligible change over the year across a basket of items. Wage rates, on average, are still rising strongly at over 5% when compared to the middle point of 2022.

Tender prices rose more slowly over the 12 months to the end of Q2 2023. AECOM’s tender price inflation index recorded a 9.1% change across this period, continuing the elevated rate of inflation seen over the last 18 months. In other words, tender prices are still rising when measured against the same time a year ago, however a slower pace of inflation is now being tracked. Although prices were still rising at a notable pace at mid-2023 compared to a year ago, this juncture very likely registers a high-water mark in this part of the tender price inflation cycle. Price inflation will continue over the remainder of 2023 and into early 2024, though at a slower rate to that recorded at times over the previous 18 months.

AECOM’s baseline forecast for tender prices is a 3% increase from Q4 2023 to Q4 2024, and a 3% increase from Q4 2024 to Q4 2025. As construction industry output moderates and is expected to continue slowing over the next 12 months, there will be on-going trend divergence across its sub-sectors. The balance of risks to forecasts of price trends is balanced evenly over the first 12-month forecast period due to competing upside and downside factors, and with a downside skew in the following period. Tender price trends retain momentum from labour rates that are still rising at well over 5% on average. Some trades are higher still, partly because of overall capacity in the industry that is historically stretched. The twist for the end of 2023 and into 2024 will be how tempted the supply chain might be to consider projects with a lower potential project margin, if aggregate industry output is set to falter.

| Quarter | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|

| 1 | 117.9 | 120.4 | 120.0 | 131.2 | 145.3 | 149.6 | 154.2 |

| 2 | 118.3 | 121.0 | 122.6 | 134.5 | 146.6 | 150.7 | 155.4 |

| 3 | 119.3 | 119.1 | 125.3 | 138.1 | 147.5 | 151.9 | 156.6 |

| 4 | 119.8 | 119.1 | 127.5 | 142.3 | 148.5 | 153.0 | 157.5 |

Aecom Tender Price Index: 2015 = 100

[top]Components of the structural frame cost

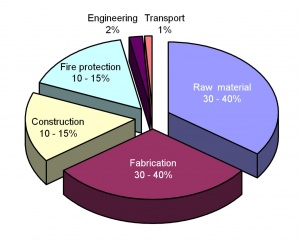

In addition to understanding the cost drivers discussed above, it is also important to appreciate the different elements that make up the overall cost of the structural frame, their typical relative proportions and the interrelationship between them.

It is often assumed that a frame with the minimum tonnage will also have the lowest cost. However, as the figure (left) shows, the raw material cost typically accounts for only 30-40% of the total frame cost, with fabrication costs also accounting for 30-40%. For more complex frame designs, with higher proportions of non-standard sections, complex connections or specialist systems with higher fabrication requirements, the overall rate per tonne is likely to be higher than for a standard frame.

The construction of the steel frame typically accounts for around 10-15% of the total frame cost. It is therefore necessary to consider whether there are features of the proposed building that would significantly affect the erection cost as this will see a corresponding impact on the total cost of the frame. The extent of repetition, piece count, the type of connections to be used and access can all have a significant impact on the cost of constructing the frame.

[top]Current cost

This article seeks to give some current indicative cost ranges for structural steel frames for three key building types:

- Low rise and short span buildings, typically 2-4 storeys

- High rise and longer span building, typically 10-15 storeys plus basement

- Industrial buildings, split into low eaves of 6-8m and high eaves of 10-13m

All of the costs include allowances for a concrete core. The rates have been developed from cost models of the different building types and for each the average weight of the structural frame has been given.

As already highlighted, before using such ‘standard ranges’ it is important to confirm the anticipated frame weight and variables such as the floor-to-floor heights with the design team to determine whether they are above or below the average and to adjust the rate used accordingly. Similarly, all of the other key cost drivers of complexity, site conditions, location, function, logistics, programme and procurement strategy should be considered in turn.

[top]Low rise and short span buildings

Rhyl New School

Low rise buildings with a regular, short span structural grid are typical features of business park offices and teaching facilities. A key feature of these buildings is flexibility, particularly for speculative business park developments that need to appeal to as many potential occupiers as possible.

The buildings often need to be easily subdivided into smaller units and have large floorplates, typically are two to four storeys and have floor-to-floor heights of 3.75-4m. These buildings will typically have a uniform grid of 6-9m that provides largely column-free space and relatively high floor-to-floor heights.

The lack of complex steel structures needed to construct the regular grid contributes to keeping the average steel frame weight down, typically 50-60kg/m2 including fittings, but this category can cover a lot of building types and functions. This central assumption therefore needs to be reviewed with the design team. Due to the low rise nature of these buildings, the fire protection requirements are not as onerous as for high rise developments and 30-60 minute fire protection would be considered standard.

More detailed information on the key cost drivers for low rise and short span buildings is available in a related article on Cost planning - Education buildings

[top]High rise and longer span buildings

High rise construction (10-15 storeys) is a typical feature of city centre construction. These buildings will often require longer structural grid spans to achieve more open space in the lettable floor areas, increasing the weight of the steel frame. To maximise floor-to-ceiling heights and increase flexibility for the building fit out, cellular beams may be adopted with openings through the web for the distribution of services.

City centre buildings are generally constructed on existing confined or irregular sites, which influence the building form and is likely to prevent the use of a regular column grid and may result in alterations to floor plates on the upper storeys.

In mixed-use schemes, transfer structures may reduce the wider grids of office or retail areas at lower levels to a more rationalised residential grid on upper floors.

All of these factors contribute to a higher average weight of the steel frame, typically 75-90kg/m² including fittings and, along with the increased complexity, result in significantly higher structural frame cost ranges than for the simpler, more regular low rise buildings.

The rate range given in the cost table below is generally applicable for buildings up to about 15 storeys; tall buildings above 15 storeys start to have fewer comparables in terms of benchmarks and are likely to have a much higher proportion of complex elements, non-standard sections sections and complicated logistics, especially when constructed on tight city centre sites. The rate range for tall buildings can be 15-20% higher than the top of the standard range.

More detailed information on the key cost drivers for high rise and longer span buildings is available in a related article on Cost planning – Multi-storey offices

[top]Industrial buildings

Industrial buildings can cover a range of uses, including warehouses, non-food retail, science parks and distribution centres. The most common building form is a single storey warehouse with varying proportions of office space on a first floor mezzanine level. The traditional structural frame for an industrial building is a steel portal frame, as flexibility of the internal space is a priority, necessitating regular column spacings and long spans for a clear internal area.

There can be variants on the standard frame design, however. For example, a steel portal frame incorporating northlights would need consideration when adjusting the standard cost ranges. The use of a northlight frame can increase the frame cost by as much as 30%.

Fire protection requirements may also be considered as part of industrial building frame costs. The most common situation in which fire protection is required in single storey buildings is where it is necessary to satisfy boundary conditions; this is a project-specific factor that will need some liaison with the design team. Generally however, single storey buildings do not require fire protection.

Another key factor in determining the frame cost of industrial buildings is the storey height of the warehouse space. While the gross internal floor area may be the same, the weight of the steel frame of a high eaves, single storey industrial building will be higher than for a low eaves building, resulting in a higher overall frame cost per m² GIFA.

Typical structural steel frame weights for low eaves buildings (6-8m high) are about 30-40kg/m² overall of GIFA, including fittings and about 40-50kg/m² for high eaves buildings (10-13m high). However, ranges for high eaves buildings are generally wider than for low eaves buildings as they can have a much higher proportion of upper floor areas, across as many as 3

mezzanine levels; the frame rates for these buildings therefore need to be looked at carefully on an individual basis.

[top]The cost table

The table below represents the costs associated with the structural framing of the three building types expressed as a cost/m2 on GIFA, and also provides some indicative cost information on floor types and fire protection.

| Type | GIFA Rate (£/m2) BCIS Index 100 | |

|---|---|---|

| Frame | Low rise, short spans, repetitive grid / sections, easy access (55kg/m2 steelwork) | 159 - 191 |

| High rise, long spans, easy access, repetitive grid (90kg/m2 steelwork) | 266 - 301 | |

| High rise, long spans, complex access, irregular grid, complex elements (110kg/m2 steelwork) | 304 - 364 | |

| Floor | Composite floors, metal decking and lightweight concrete topping | 111 - 151 |

| Hollowcore precast concrete composite floor with concrete topping | 138 - 194 | |

| Fire protection | Factory applied intumescent (60 minutes resistance) | 29 - 40 |

| Factory applied intumescent (90 minutes resistance) | 38 -58 | |

| Portal frames | Large span single storey building with low eaves (6 - 8 m), 35kg/m2 steelwork | 114 - 149 |

| Large span single storey building with high eaves (10 - 13 m), 45kg/m2 steelwork | 139 - 178 | |

To use the table:

- Identify which frame type most closely relates to the project under consideration

- Select and add the floor type under consideration

- Add fire protection if required

For example, for a low rise, short span building with a composite metal deck floor and 60 minutes fire resistance, the overall frame rate (based on the average of each range) would be:

£174.50 + £114.00 + £34.50 = £324.00 per m² GIFA

The rates should then be adjusted using location indices; the table provided below contains a selection of indices as published and updated by the BCIS.

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

| Central London | 122 | Nottingham | 102 |

| Manchester | 102 | Glasgow | 92 |

| Birmingham | 98 | Newcastle | 89 |

| Liverpool | 100 | Cardiff | 102 |

| Leeds | 90 | Dublin+ | 90 |

+Aecom index

[top]Cost planning through the design stages

Main article: Cost planning through design stages

(Image courtesy of FABSEC Ltd.)

A key component of the cost of any building type is the frame which, for multi-storey buildings, accounts for approximately 10% of the overall building cost. The accuracy of any costing exercise depends on the level of design information on which it is based. As the design develops and more information becomes available, so the extent to which the cost can be detailed increases.

RIBA Stage 1 - 2

The budget set at the early stages of the design needs to reflect the final build cost despite limited information being available. This means rates used during this phase need to include items which are not yet quantifiable.

At this critical stage in the project much of the decision making on the frame construction method takes place. The steel frame design is represented as a relative weight (kg/m2) as opposed to a framing layout with beam sizes. Costs and rates based on a kg/m2 design intent should consider the following:

- The steelwork quantity based on Gross Internal Floor Area (GIFA) or relative areas that the steel frame covers, which will depend on the building type and loading requirements.

- How the kg/m2 benchmarks against similar buildings.

- If the quantity of steel (kg/m2) accounts for fittings and steel-to-steel connections or whether an additional allowance needs to be made.

- The potential mix of steel members: columns, beams, fabricated/sections, etc.

- Consideration of the fire protection method and fire rating.

- Non-standard details such as cantilevers and transfers.

- The erection and lifting strategy and whether there will be a need for some members to be erected with mobile rather than tower cranes.

In addition, typical items that would not be covered in primary steelwork (kg/m2) but which will need to be considered include:

- Secondary steelwork including framing to risers, lifts and cladding.

- Connections to concrete or existing structures.

Following consideration of all of the above a ‘blended all in’ rate is then derived and applied to the calculated kg/m2. These rates will then be reviewed against similar projects and steel frame types which provide analysis against benchmarks.

Market testing should also be sought through consultation with steelwork contractors to ensure the accuracy of rates, forming a credible foundation for the steelwork costings to be developed in the subsequent design stages.

RIBA Stage 3-4

As the design progresses, technical information from the structural engineer on the proposed frame will become available, allowing a more accurate and developed quantification of the frame cost, which will now include a piece count and review of the design evolution.

Other information likely to become available at this stage includes:

- Drawings showing the frame configuration

- Cores and shear walls

- Column and beam sizes and types

- Floor construction details

- The strategy for integration of mechanical and electrical services.

The developing steel frame design can then be broken down into four components:

- Main members: primary supports that carry the loads, such as beams, columns and trusses

- Secondary members: those carrying specific loads

- Fittings and connections: bracing, stiffeners and the joints that transfer forces between the structural elements

- Miscellaneous items such as temporary steelwork, metal decking to composite floors, stairs, riser decking, external core angles, tower crane grillages, and stubs for BMU tracks.

It is still important at this stage in the design process to continue to determine and redress what has not been included within the drawings and ensure that these missing elements are taken into account. For example the extent of secondary members should not be overlooked as these can account for a significant proportion of the overall steel piece count and cost.

To calculate the cost of the structural frame, each of the components noted above will have a rate per tonne applied and then totalled. This rate should include the raw materials, fabrication, construction, fire protection, engineering and transport costs.

There are risks and limitations in cost planning steelwork based on a simple rate per tonne as this does not take into account specific features such as long-span beams, cranking or tapering, curvature of steel, hollow sections, cantilevers, irregularity of grid, back propping and movement connections, all of which may require an adjustment to the basic applied steelwork rate.

[top]Cost comparison study

Main articles: Cost comparison studies

In November 2011, the BCSA and Tata Steel commissioned Gardiner & Theobald (G&T), Peter Brett Associates (PBA) and Mace Group to undertake an impartial study of current construction practice for multi-storey office construction to provide cost and programme guidance for Quantity Surveyors and design teams. PBA identified and designed representative framing solutions for two typical office buildings (Building 1 - A business park office, and Building 2 - A city centre office). G&T provided cost information for each frame option and Mace considered buildability, logistics and programme. PBA also carried out a cradle-to-cradle embodied carbon assessment on Building 2. The costs were regularly updated by G&T through to October 2016, and published quarterly in Building magazine as the ‘Steel Insight’ series. The last update of this study is available here.

Later in 2016, the BCSA and Steel for Life commissioned AECOM to provide impartial cost guidance applicable to a broad range of construction professionals. Published quarterly in Building magazine, ‘Costing Steelwork’ is a series in which AECOM provides guidance on the key elements of costing structural steelwork. These articles examine the key cost drivers for different sectors and provide up-to-date cost ranges for various frame types that can be used as a comparative cost benchmark.

The series comprises studies into office, education, residential/mixed-use, retail and industrial buildings, and a key feature is a series of building type specific cost comparisons based on actual buildings. The buildings selected were originally part of the Target Zero study conducted by a consortium of organisations including Tata Steel, AECOM, SCI, Cyril Sweet and BCSA in 2010 to provide guidance on the design and construction of sustainable, low and zero carbon buildings in the UK.

The cost comparisons presented in the ‘Costing Steelwork’ series update the cost models developed for the Target Zero project. The cost comparison studies have been suspended for the time being as it is felt that the buildings’ designs are no longer reflective of current practices. Steel for Life and AECOM are collaborating on a new model to be released in the future, so please take this into consideration when using the data below, which was last produced in December 2023.

[top]Office building

The building used for the cost model is a multi-storey office structure; One Kingdom Street, London. The project is located in the Waterside regeneration area near Paddington railway station in Central London. This Grade A office building was completed in 2008.

The building’s key features are:

- 10 storeys, with two levels of basement

- Typical clear spans of 12m x 10.5m

- Three cores - one main core with open atrium, scenic atrium bridges and lifts

- Plant at roof level

Two structural options for the office building were assessed; a steel frame comprising fabricated cellular steel beams acting compositely with a lightweight concrete slab on a profiled steel deck, and a 350mm thick post tensioned concrete flat slab with a 650 x 1050mm perimeter beam.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4, 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below.

| Elements | Steel cellular composite | Post-tensioned concrete flat slab |

|---|---|---|

| Substructure | 93 | 98 |

| Frame and upper floors | 556 | 540 |

| Total building | 3,660 | 3,750 |

The analysis shows that the cost of the steel composite solution is 3% higher than the post-tensioned concrete flat slab alternative in terms of the frame and upper floors, but 2% lower on a total building basis. The lighter frame weight and the increased speed of erection results in reduced foundations and a quicker programme. The reduced timescale is the main reason for the overall building cost to be less in the steel composite option.

[top]Secondary school building

The building used for the cost model is the Christ the King Centre for Learning a secondary school in Knowsley, Merseyside.

The building’s key features are:

- Three storeys, with no basement levels

- Typical clear spans of 9m x 9m

- 591m2 sports hall (with glulam frame),

- 770 m2 activity area and atrium

- Plant at roof level

Three structural options for the building were assessed; a steel frame with 250mm hollowcore precast concrete planks and a 75mm structural screed, an in situ 350mm reinforced concrete flat slab with 400 x 400mm columns, and a steel frame acting compositely with a 130mm concrete topping on structural metal deck.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below.

| Elements | Steel and precast hollowcore planks | In situ concrete flat slab | Steel composite |

|---|---|---|---|

| Frame and upper floors | 379 | 321 | 340 |

| Total building | 4,090 | 4,048 | 4,010 |

The comparative costs highlight the importance of considering total building cost when selecting the structural frame material during design. The concrete flat slab option has a marginally lower frame and floor cost compared with the steel composite option, but on a total building basis, the steel composite option has a lower overall cost (£4,010/m2 compared with £4,048/m2). This is because of lower substructure and roof costs and lower preliminaries resulting from the shorter programme.

[top]Distribution warehouse

The building used for the cost model is a distribution warehouse on ProLogis Park in Stoke-on-Trent.

The building’s key features are:

- Warehouse: four-span, steel portal frame, with a net internal floor area of 34,000m2

- Office: 1,400m2, two-storey office wing with a braced steel frame with columns.

Three structural options for the building were assessed; a steel portal frame with a simple roof solution, a hybrid option, consisting of precast concrete columns and glulam beams with timber rafters, and a steel portal frame with a northlight roof solution.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below.

| Elements | Steel portal frame | Glulam beams and purlins supported on concrete columns | Steel portal frame with northlights |

|---|---|---|---|

| Warehouse | 123 | 187 | 142 |

| Office | 187 | 227 | 187 |

| Total frame | 127 | 189 | 145 |

| Total building | 920 | 995 | 963 |

The steel portal frame option provides the optimum build value at £920/m2, with the hybrid concrete/glulam option being the least cost-efficient. This is primarily due to the cost premium for the structural members required to provide the required spans, which are otherwise efficiently catered for in the steelwork solution. The consequence of having a hybrid option is that the component elements are from different suppliers, which contributes to the increases in cost.

The northlights option is directly comparable with the portal frame in relation to the warehouse and office frame; the variance is in the roof framing. There is significantly more roof framing to form the northlights. The additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area.

[top]Supermarket building

The building used for the cost model is an Asda supermarket in Stockton-on-Tees, Cleveland.

The building’s key features are:

- Total floor area of 9,393m2 arranged over two levels

- Retail area based on a 12m x 12m structural grid.

Three structural options for the building were assessed; a steel portal frame on CFA piles, glulam timber rafters and columns on CFA piles, and a steel portal frame with a northlight roof solution on driven steel piles.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below.

| Elements | Steel portal frame | Glulam timber rafters and columns | Steel portal frame with northlights |

|---|---|---|---|

| Structural unit cost | 184 | 234 | 207 |

| Total building unit cost | 3,345 | 3,400 | 3,358 |

The steel portal frame option provides the optimum build value at £3,345/m2, with the glulam option the least cost-efficient. The increased cost is due to the direct comparison of the steel frame solution against the glulam columns and beams/rafters. A significant proportion of the cost for the building is in the M&E services and fit-out elements, which effectively reduce the impact of the structural changes to the overall building.

The northlights option is directly comparable with the portal frame in relation to the main supermarket frame; the variance is in the roof framing as there is significantly more roof framing to form the northlights. The additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area.

[top]Residential / mixed-use building

The building used for the cost model is the Holiday Inn tower located in MediaCityUK, Manchester. Phase one of MediaCityUK started in 2007 and completed in 2011.

The building’s key features are:

- 67m-high, 17-storey tower including 5 office floors and 8 hotel accommodation floors

- Total floor area of 18,625m2 arranged over two levels

- Approximate plan dimensions of 74m x 15.3m

- Columns located on a 6.35m x 2.6m x 6.35m grid spaced at 7.5m.

Three frame options were considered to establish the optimum solution for the building, a steel frame with Slimdek floors, a concrete flat slab and a steel composite deck on cellular beams (offices) and UCs used as beams (hotel).

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2023. The costs, which include preliminaries, overheads and profit and a contingency, are summarised in the table below.

| Elements | Steel frame with Slimdek floors | Concrete flat slab | Steel frame with composite deck on cellular beams (offices) and UCs used as beams (hotel) |

|---|---|---|---|

| Structural unit cost | 688 | 500 | 470 |

| Total building unit cost | 3,705 | 3,490 | 3,430 |

The steel frame with composite deck provides the optimum build value at £3,430/m2.