Difference between revisions of "Cost planning - Industrial buildings"

Zoe Williams (talk | contribs) |

|||

| (17 intermediate revisions by 2 users not shown) | |||

| Line 2: | Line 2: | ||

The industrial sector covers a range of building functions and types, including [[Retail_buildings#Distribution centres|distribution centres]], warehouses and small industrial units. The sector is characterised by a common requirement for long span structural solutions, and this article therefore also considers [[Retail_buildings#Supermarkets|supermarkets]], which typically share this requirement. | The industrial sector covers a range of building functions and types, including [[Retail_buildings#Distribution centres|distribution centres]], warehouses and small industrial units. The sector is characterised by a common requirement for long span structural solutions, and this article therefore also considers [[Retail_buildings#Supermarkets|supermarkets]], which typically share this requirement. | ||

| − | Industrial is a key sector for structural steelwork. Standard steel [[Portal_frames|portal frame]] construction dominates the sector, but other steel solutions, such as [[Trusses|trusses]], [[Long-span_beams|long span beams]] and [[Steel_construction_products#Fabricated products|fabricated sections]] may also be used to achieve the required long spans. The efficiency and cost effectiveness of the standard steel [[Portal_frames|portal frame]] in this sector is reflected in the latest [[#External links|Construction Markets]] survey commissioned by the BCSA and Steel for Life. It shows that in | + | Industrial is a key sector for structural steelwork. Standard steel [[Portal_frames|portal frame]] construction dominates the sector, but other steel solutions, such as [[Trusses|trusses]], [[Long-span_beams|long span beams]] and [[Steel_construction_products#Fabricated products|fabricated sections]] may also be used to achieve the required long spans. The efficiency and cost effectiveness of the standard steel [[Portal_frames|portal frame]] in this sector is reflected in the latest [[#External links|Construction Markets]] survey commissioned by the BCSA and Steel for Life. It shows that in 2024, steel frames accounted for 98.3% of all industrial shed building construction in the UK compared with 0.5% for insitu concrete, 0.8% for precast concrete and 0.3% for load bearing masonry. |

This article focuses on the cost factors and the [[Cost_planning_through_design_stages|cost planning]] of steel framed [[Single storey industrial buildings|industrial buildings]]. It builds on the general guidance on the [[Cost of structural steelwork|cost of structural steelwork]], and [[Cost planning through design stages|cost planning through design stages]] for structural steel framed buildings by considering the [[#Industrial buildings: Typical characteristics|typical design and construction characteristics]] of industrial buildings. It explores the importance of programme, the [[#Key frame cost drivers for industrial buildings|key cost drivers]] for the industrial sector and the principal factors to consider when using [[Cost_of_structural_steelwork#The_cost_table|standard cost ranges]] to ensure that realistic frame costs are achieved. | This article focuses on the cost factors and the [[Cost_planning_through_design_stages|cost planning]] of steel framed [[Single storey industrial buildings|industrial buildings]]. It builds on the general guidance on the [[Cost of structural steelwork|cost of structural steelwork]], and [[Cost planning through design stages|cost planning through design stages]] for structural steel framed buildings by considering the [[#Industrial buildings: Typical characteristics|typical design and construction characteristics]] of industrial buildings. It explores the importance of programme, the [[#Key frame cost drivers for industrial buildings|key cost drivers]] for the industrial sector and the principal factors to consider when using [[Cost_of_structural_steelwork#The_cost_table|standard cost ranges]] to ensure that realistic frame costs are achieved. | ||

| Line 33: | Line 33: | ||

==Key frame cost drivers for industrial buildings== | ==Key frame cost drivers for industrial buildings== | ||

| − | Given the existence of a number of common characteristics and requirements across the sector, it is not surprising that many [[Single_storey_industrial_buildings|industrial buildings]] and [[Retail_buildings#Supermarkets|supermarkets]] have similar frame costs. Typically the frame cost range (excluding [[Building_envelopes#Purlin and side rail options|cladding rails and purlins]]) for low eaves (4m to 8m high) single storey industrial units adopting a steel [[Portal_frames|portal frame]] solution will be between | + | Given the existence of a number of common characteristics and requirements across the sector, it is not surprising that many [[Single_storey_industrial_buildings|industrial buildings]] and [[Retail_buildings#Supermarkets|supermarkets]] have similar frame costs. Typically the frame cost range (excluding [[Building_envelopes#Purlin and side rail options|cladding rails and purlins]]) for low eaves (4m to 8m high) single storey industrial units adopting a steel [[Portal_frames|portal frame]] solution will be between £108 and £142 per m<sup>2</sup> GIFA ([[#External links|BCIS]] location index 100), however for high eaves buildings (10m to 13m high) the cost range will be higher as they have a higher steel frame weight per m<sup>2</sup> GIFA and a range of £132 to £169 per m<sup>2</sup> GIFA is more appropriate, as reflected in the [[Cost_of_structural_steelwork#The_cost_table|cost table]] below. |

{|class="wikitable" width=750 style="text-align: center" | {|class="wikitable" width=750 style="text-align: center" | ||

| − | |+'''Table of indicative cost ranges ( | + | |+'''Table of indicative cost ranges (Q4, 2025) based on Gross Internal Floor Area (GIFA)''' |

|- | |- | ||

!colspan="2"|'''Type'''!!'''GIFA Rate (£/m<sup>2</sup>)<br>BCIS Index 100''' | !colspan="2"|'''Type'''!!'''GIFA Rate (£/m<sup>2</sup>)<br>BCIS Index 100''' | ||

|- | |- | ||

| − | |style="text-align: left" rowspan="3"|Frame||style="text-align: left"|Low rise, short spans, repetitive grid / sections, easy access (55kg/m<sup>2</sup> steelwork)|| | + | |style="text-align: left" rowspan="3"|Frame||style="text-align: left"|Low rise, short spans, repetitive grid / sections, easy access (55kg/m<sup>2</sup> steelwork)||159 - 191 |

|- | |- | ||

| − | |style="text-align: left"|High rise, long spans, easy access, repetitive grid (90kg/m<sup>2</sup> steelwork)|| | + | |style="text-align: left"|High rise, long spans, easy access, repetitive grid (90kg/m<sup>2</sup> steelwork)||266 - 301 |

|- | |- | ||

| − | |style="text-align: left"|High rise, long spans, complex access, irregular grid, complex elements (110kg/m<sup>2</sup> steelwork)|| | + | |style="text-align: left"|High rise, long spans, complex access, irregular grid, complex elements (110kg/m<sup>2</sup> steelwork)||304 - 364 |

|- | |- | ||

| − | |style="text-align: left" rowspan="2"|Floor||style="text-align: left"|Composite floors, metal decking and lightweight concrete topping|| | + | |style="text-align: left" rowspan="2"|Floor||style="text-align: left"|Composite floors, metal decking and lightweight concrete topping||111 - 151 |

|- | |- | ||

| − | |style="text-align: left"|Hollowcore precast concrete composite floor with concrete topping|| | + | |style="text-align: left"|Hollowcore precast concrete composite floor with concrete topping||138 - 194 |

|- | |- | ||

| − | |style="text-align: left" rowspan="2"|Fire protection||style="text-align: left"|Factory applied intumescent (60 minutes resistance)|| | + | |style="text-align: left" rowspan="2"|Fire protection||style="text-align: left"|Factory applied intumescent (60 minutes resistance)||29 - 40 |

|- | |- | ||

| − | |style="text-align: left"|Factory applied intumescent (90 minutes resistance)|| | + | |style="text-align: left"|Factory applied intumescent (90 minutes resistance)||38 -58 |

|- | |- | ||

| − | |style="text-align: left" rowspan="2"|Portal frames||style="text-align: left"|Large span single storey building with low eaves (6 - 8 m)|| | + | |style="text-align: left" rowspan="2"|Portal frames||style="text-align: left"|Large span single storey building with low eaves (6 - 8 m), 35kg/m<sup>2</sup> steelwork||114 - 149 |

|- | |- | ||

| − | |style="text-align: left"|Large span single storey building with high eaves (10 - 13 m)|| | + | |style="text-align: left"|Large span single storey building with high eaves (10 - 13 m), 45kg/m<sup>2</sup> steelwork||139 - 178 |

|} | |} | ||

<br> | <br> | ||

Latest revision as of 10:10, 15 December 2025

The industrial sector covers a range of building functions and types, including distribution centres, warehouses and small industrial units. The sector is characterised by a common requirement for long span structural solutions, and this article therefore also considers supermarkets, which typically share this requirement.

Industrial is a key sector for structural steelwork. Standard steel portal frame construction dominates the sector, but other steel solutions, such as trusses, long span beams and fabricated sections may also be used to achieve the required long spans. The efficiency and cost effectiveness of the standard steel portal frame in this sector is reflected in the latest Construction Markets survey commissioned by the BCSA and Steel for Life. It shows that in 2024, steel frames accounted for 98.3% of all industrial shed building construction in the UK compared with 0.5% for insitu concrete, 0.8% for precast concrete and 0.3% for load bearing masonry.

This article focuses on the cost factors and the cost planning of steel framed industrial buildings. It builds on the general guidance on the cost of structural steelwork, and cost planning through design stages for structural steel framed buildings by considering the typical design and construction characteristics of industrial buildings. It explores the importance of programme, the key cost drivers for the industrial sector and the principal factors to consider when using standard cost ranges to ensure that realistic frame costs are achieved.

This article also examines the issue of sustainability with respect to frame selection, which is a further key factor in the owner occupier industrial sector, both as a method to reduce costs in use and as a key corporate driver.

[top]Industrial buildings: Typical characteristics

The industrial sector comprises buildings with a wide range of uses, from out of town retail buildings and supermarkets, distribution centres and warehouses to science parks and light industrial buildings.

While these buildings have different functions and processes occurring within the space, their common design drivers of long spans, clear internal space and high bays to provide highly flexible internal layouts and to maximise floor plate efficiency result in a small range of typical structural design solutions across the sector.

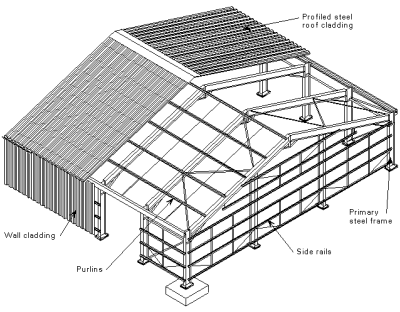

The most commonly adopted structural solution to address these requirements is a steel portal frame. Portal frames are relatively lightweight structures that provide large clear internal spans and flexible space. The frame comprises columns and rafters, with localised haunches at the eaves to minimise rafter section size and at the apex to accommodate the connection between the rafters. Unlike other frames, the building envelope provides restraint to the structural steelwork, resulting in a very efficient structure. They typically include metal cladding and roofing but can accommodate a range of cladding materials where planning or aesthetic considerations are important.

A steel portal frame can efficiently deliver large spans from 25m to 40m with standard spacings between frames of 6m to 10m but typically 8m. Where multi-bay portals are required, a valley beam is often provided to remove alternate internal columns in a hit-and-miss arrangement to minimise the impact of the structure on the internal space.

Steel portal frames can also be constructed to a range of building heights to provide the high eaves required for certain building functions. For example, distribution centres typically include overhead craneage and therefore require a clear internal height of 10m to 13m or more, while supermarkets and warehouses are more likely to require 4m to 6m clear height depending on the storage racking system used.

As well as being able to provide clear internal height, the flexible nature of the space provided by a portal frame can also allow ancillary spaces to be incorporated easily within the main structure. Both industrial buildings and supermarkets will require a range of ancillary spaces from back of house offices to welfare and storage areas to be incorporated alongside the primary building function and in high eaves buildings it is common for these to be situated on first floor mezzanine floor space to avoid using the more valuable open plan spaces.

In addition to these benefits, a steel portal frame delivers a number of other advantages in the industrial sector. In particular, the lightweight nature of the frame can reduce the size of the required foundations and therefore the extent of the associated excavation, substructure and ground risk. This can be particularly beneficial on previously developed or urban sites, where substructure costs are a significant proportion of overall building costs.

A further key requirement of the sector, particularly for retail buildings, is speed of delivery of the building. A steel portal frame can offer programme advantages over other frame materials through both a quicker frame erection time, as elements can be delivered to site prefabricated and tend to be similar or repetitive, and also as noted above, potentially through reduced construction periods for substructure due to lighter frame weights. This can result in quicker delivery as well as reduced finance and cost of preliminaries.

While services provision is not the same issue for industrial buildings as it is for other sectors, if required, services can be integrated by providing openings in the webs of the rafters or alternatively using cellular beams for the rafters. However, in most cases, there is sufficient space below the frame to accommodate the services without compromising the operation of the building. It is most common to see the cellular beam arrangement on out of town retail buildings speculatively built to appeal to a range of potential tenants or purchasers.

While steel portal frames are the typically adopted frame type for the majority of industrial buildings, other steel solutions are available where there are more particular requirements. For example, steel trusses can be utilised for large distribution centres that require long spans as they can span from 50m to 80m and provide for services distribution within their depth. Where very long spans are required, space frames can be adopted; these are three dimensional trusses that span in two directions, are lightweight and can span up to 100m.

For developments that incorporate retail space on the ground floor but commercial or residential space at upper floor levels – a configuration that is becoming more common in the sector as a consequence of planning policy – long span beams can be used to provide ranges of 12m to 18m and offer relatively open plan retail space at ground floor level but also retain a grid that is compatible with other functions above.

[top]Key frame cost drivers for industrial buildings

Given the existence of a number of common characteristics and requirements across the sector, it is not surprising that many industrial buildings and supermarkets have similar frame costs. Typically the frame cost range (excluding cladding rails and purlins) for low eaves (4m to 8m high) single storey industrial units adopting a steel portal frame solution will be between £108 and £142 per m2 GIFA (BCIS location index 100), however for high eaves buildings (10m to 13m high) the cost range will be higher as they have a higher steel frame weight per m2 GIFA and a range of £132 to £169 per m2 GIFA is more appropriate, as reflected in the cost table below.

| Type | GIFA Rate (£/m2) BCIS Index 100 | |

|---|---|---|

| Frame | Low rise, short spans, repetitive grid / sections, easy access (55kg/m2 steelwork) | 159 - 191 |

| High rise, long spans, easy access, repetitive grid (90kg/m2 steelwork) | 266 - 301 | |

| High rise, long spans, complex access, irregular grid, complex elements (110kg/m2 steelwork) | 304 - 364 | |

| Floor | Composite floors, metal decking and lightweight concrete topping | 111 - 151 |

| Hollowcore precast concrete composite floor with concrete topping | 138 - 194 | |

| Fire protection | Factory applied intumescent (60 minutes resistance) | 29 - 40 |

| Factory applied intumescent (90 minutes resistance) | 38 -58 | |

| Portal frames | Large span single storey building with low eaves (6 - 8 m), 35kg/m2 steelwork | 114 - 149 |

| Large span single storey building with high eaves (10 - 13 m), 45kg/m2 steelwork | 139 - 178 | |

However, as with all building types, it is still necessary during cost planning to consider a number of characteristics that can vary from site to site and project to project but which may impact on the structural frame cost of any individual building.

[top]Location, site constraints and site configuration

For all building types, location, site constraints and site configuration should always be considered as the specific site will have a direct impact on the proposed building, influencing both the achievable design and the costs of construction. The characteristics of a proposed site will vary between an urban location and an out of town industrial complex or business park. The standard cost ranges are based on an out of town, less constrained location, which is typical for the majority of industrial buildings, so adjustments will be required for tight or city centre sites, which are likely to attract additional logistics and cost of preliminaries.

Site configuration can also impact on the structural design through floor plate arrangement. Where the structural grid has to change across the building to account for site factors or adjacent buildings, the efficiencies of repetition across the frame may not be realised. More repetitive structures provide material cost and on site erection efficiencies, so factors that reduce the level of repetition need to be assessed during planning as they may result in additional costs above those captured in the standard frame cost ranges.

[top]Building height

Building height is a particularly important cost driver for industrial buildings and should be a key consideration during early cost planning when estimates are likely to be based on a frame weight per m2 of floor area. While the gross internal floor area may be the same, the weight of the steel frame will vary between a low and high eaves building on a kg per m2 basis, resulting in different overall frame costs per m2 GIFA.

Typical structural steel frame weights for low eaves buildings (4m to 8m high) are around 30-40kg per m2 GIFA including fittings, but are usually around 40-50kg per m2 for high eaves buildings (10m to 13m high). For high eaves buildings it is therefore important to seek guidance from the structural engineer as to the proposed frame weight for the building as it could be around 20% higher than for a low eaves single storey portal framed building. Furthermore, should the proposed building have a very high bay configuration, with clear heights of up to 20m, adjustments will need to be made to the high eaves typical cost range to account for the further increased steel frame weight.

[top]Ancillary accommodation

Building height is generally driven by the building function and this is also a key driver of the requirements for ancillary accommodation and the structure needed to provide it, which will also impact on the overall building frame weight. For high eaves buildings, the extent of the proposed upper floor areas should be considered as this can vary significantly between different buildings, with ancillary space potentially being provided across as many as three mezzanine levels. The frame costs for these buildings will therefore need to be looked at carefully on a building by building basis with adjustments likely to be required to standard cost ranges.

[top]Fire protection

A further cost consideration for industrial buildings is the required level of fire protection for the structure. Typically, fire protection is only required in single storey buildings where it is needed to satisfy boundary conditions or where there is a need to access the roof (e.g. for plant access). However for buildings with upper floor levels, mezzanines or internal offices the fire strategy will need to be clarified with the design team during cost planning to ensure that the extent and method of protection required is captured.

[top]Design features

At the early design stages it is also important to gain an understanding of any design features that may require variations to the standard steel portal frame. For example, the incorporation of northlights for architectural, planning or site orientation reasons can result in an increase to the frame cost by as much as 35% due to the additional steelwork required to form the more complex roof profile.

[top]Structural frame types and sustainability

A developing trend in recent years within the industrial and supermarket sectors is for the decision of building materials to increasingly be considered from a sustainability and long term value perspective, as well as the more traditional drivers of buildability, cost and programme.

This has not only been driven by government legislation and key requirements of building operational carbon performance, as set out in Part L of the Building Regulations, but also by owner occupier clients within the sector who have a strong incentive to reduce costs in use across the life of the building and through a recognition from the supermarket sector that sustainability can be a point of differentiation in the market.

It is therefore becoming more typical during the early design stages for assessments of sustainability to be undertaken across the main building elements to ensure that the material choices aide the achievement of the sustainability requirements for the project, whether driven by Part L or corporate goals. As part of the review of key building elements, the structural frame material choice is likely to be reviewed and it is therefore important to have an understanding of the relative sustainable performance of structural steel frames in the industrial sector.

Research on the relative sustainable performance of different structural frame types for both a distribution centre and supermarket has been carried out by AECOM and Sweett Group in the Target Zero project, which considered the performance of a number of frame types in terms of both operational carbon emissions and embodied energy.

[top]Operational carbon

- Target Zero Guides

The Target Zero analysis demonstrated that in terms of operational carbon emissions, the frame material adopted does not have a significant impact on the overall performance of either the warehouse building (less than 3.5%) or supermarket (3.8%).

For the warehouse building, the report found that there was less than 1% variance in operational carbon emissions between a steel portal framed building and a precast concrete column and glulam beam structure, yet there was a 12% cost premium associated with the glulam and concrete option in terms of overall cost and an 83% premium on the cost of the structural frame itself.

Similarly, for the supermarket, it was also found that there was less than 1% variance in operational carbon emissions between the two considered frame options of a steel portal frame and a glulam structure, however there was a 2.4% cost premium for the glulam option overall driven by a 20-25% difference in the cost of the structural frame.

This research suggests that while some recent supermarket developments have incorporated a glulam or part glulam structure for sustainability reasons, despite the potential cost premium, the frame material choice actually only makes a very small difference to the overall operational carbon emissions of the building and the difference between the performance of the steel and glulam frames was less than 1% for both building types. Therefore, varying the frame material is unlikely to be a particularly cost effective way of achieving sustainable targets for proposed industrial or supermarket developments.

Indeed, the Target Zero studies demonstrated that for both the distribution warehouse building and the supermarket, consideration of the building lighting strategy was the most important factor in delivering cost-effective carbon savings, as lighting is typically the greatest energy demand in this sector. Indeed, the use of more efficient lighting systems alone delivered the 2010 Part L compliance target of reducing regulated carbon emissions by 25% for the distribution warehouse.

During the design stages, it is becoming more common to undertake assessments on the relative sustainable performance of different structural frame options by considering embodied carbon impacts alongside operational carbon emissions.

[top]Embodied carbon

Embodied carbon assesses the total carbon dioxide emissions associated with the building but excluding the operational carbon occurring during the building use.

While Part L of the Building Regulations sets out assessment methodology and compliance requirements for operational carbon , consideration of embodied carbon is currently omitted, which can result in assessments following different methodologies.

However, it is important that assessments are undertaken firstly on a whole building level rather than on an elemental basis and secondly on a whole lifecycle (or cradle to cradle) basis.

Consideration of the whole building ensures that the intensity of material usage and the consequential impacts of frame choice on substructure are considered. It can often be overlooked that a significant proportion of a building’s embodied carbon is in the substructure and that different framing materials have different implications for their design and embodied carbon impact, with lighter frames typically reducing the extent of foundations and excavation.

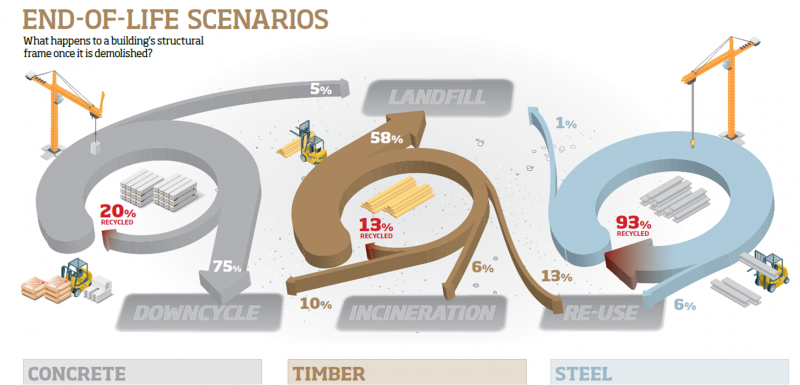

In addition, the whole building lifecycle should be assessed to determine the total embodied carbon impact. Some types of assessment omit the construction and end of life impacts and effectively assume that all materials perform in the same way. This is an oversimplification as there are differences in the end of life outcomes of materials, for example concrete is recovered and crushed for aggregate, steel and other metals are reused or recycled and a high proportion of timber goes to landfill.

The Target Zero reports demonstrated that while operational carbon emissions were similar between the different frame types, there were significant differences between the embodied energy performances for both the distribution warehouse and supermarket.

The adoption of the precast concrete and glulam structure for the distribution warehouse would have resulted in a 14% higher embodied carbon impact than the use of a steel portal framed structure and the glulam framed supermarket had a 2.4% higher embodied carbon impact than the steel portal frame .

This difference is largely due to differences in the end of life outcomes of steel and timber. Structural steel has high recycling and reuse rates compared with those for timber[1]. As the timber in landfill decomposes it releases carbon dioxide and methane and while modern landfill sites are designed to collect methane, gas capture rates are typically 51% of all gas generated.

[top]References

[top]Resources

- Steel Insight 6 – Industrial buildings, February 2013, Building magazine

- Steel Insight 12 – Cost update and case studies: Industrial buildings, March 2015, Building Magazine

- Steel Insight 18 – Cost update and case studies: Industrial buildings, October 2016, Building Magazine

- Guidance on the design and construction of sustainable, low carbon warehouse buildings

- Guidance on the design and construction of sustainable, low carbon supermarket buildings

- Costing Steelwork 3 – Industrial Buildings, October 2017

[top]See also

- Cost of structural steelwork

- Cost planning through design stages

- Single storey industrial buildings

- Retail buildings

- Portal frames

- Building envelopes

- Fire protecting structural steelwork

- Single storey buildings in fire boundary conditions

- Sustainability

- Sustainable construction legislation, regulation and drivers

- Life cycle assessment and embodied carbon

- Operational carbon

- Recycling and reuse

- Target Zero